How to convert your short-term (Airbnb, VRBO) to long-term rental properties?

Income impacted by Covid-19? Wondering if you should convert your Airbnb to long-term rental? We show you how.

Investing in a short term rental property produces higher returns than long-term rentals. The rise in popularity of Airbnb, VRBO, HomeAway, etc., to facilitate short term rentals has made it easy to earn income to pay off a significant part of the expenses. Studies show that 70% of the expenses of a two-bedroom home can be covered by renting out one room. 82 percent of the people think this is a good monkey making strategy.

The market conditions for vacation rentals are tricky for the time being. More people are staying in place. With people staying in place, they realize they need bigger houses, causing house sales and prices to increase in many markets. For renters, this could imply that they need bigger or better homes to rent.

The advantages of short-term rental property

You can choose when to rent and when not to rent, based on your personal needs. This flexibility is hard to find in long-term rentals. Also, the rent per night is usually higher in short-term rentals. You get to meet new people and experience aspects of their culture in the comfort of your home. It’s a great way to make friends across the globe.

Why consider long term rental property?

Long-term tenants bring a steady stream of income. They are lower risk and hence offer a lower return. Here are some factors that drive the shift to long-term rentals.

Change in the local laws

Since the rise of Airbnb and other sites, many hotels have experienced a short-fall on demand. There have been changes in Bills to address this situation. For example, cities like Los Angeles, New York, San Francisco, Las Vegas, and Santa Monica have restrictions on who can rent out and how long the unit can be rented for. Some cities even require the owner to stay in the property. Cities like Paris and Barcelona require registration / license to operate short-term rentals. In Barcelona, Airbnb is an entire apartment or house bought and managed by agencies. You are competing with a larger organization in this scenario. If your local laws are shifting, a long-term rental might be a more viable, low-risk option.

A sudden downfall in the demand

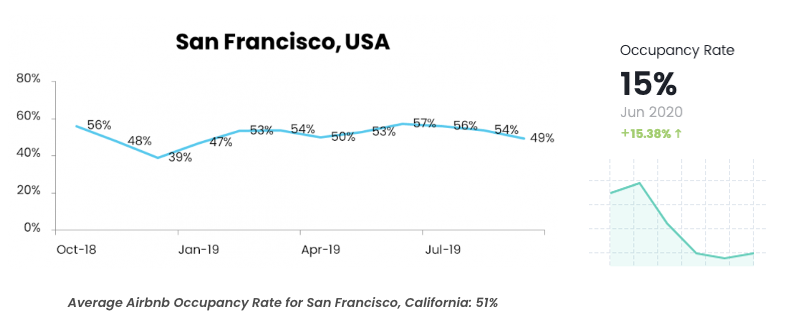

Tourism in most locations varies by season; properties at summer destinations may be left vacant during the winters, and vice versa. The demand is seasonal – you could have 20% or 70% occupancy for the same city at different times of the year. The occupancy rate also varies by location, with the average occupancy at 48%. The chart on the left shows the occupancy rate for San Francisco from Oct 2018 to Sep 2019.

Impact of Covid-19

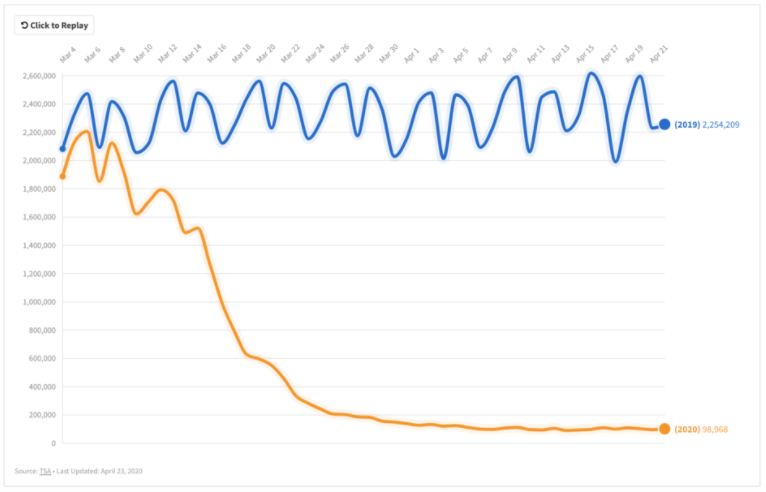

Also, in unusual times like this recent pandemic, the tourism business has suffered a significant downfall, and the short-term rental market is at a loss too. The image on the right above shows the current occupancy rate, which is likely impacted due to Covid-19. While staycations are on the rise, global travel has slowed down significantly impacting the vacation rental economy. Air travel has reduced significantly. TSA foot traffic is down 90% this year.

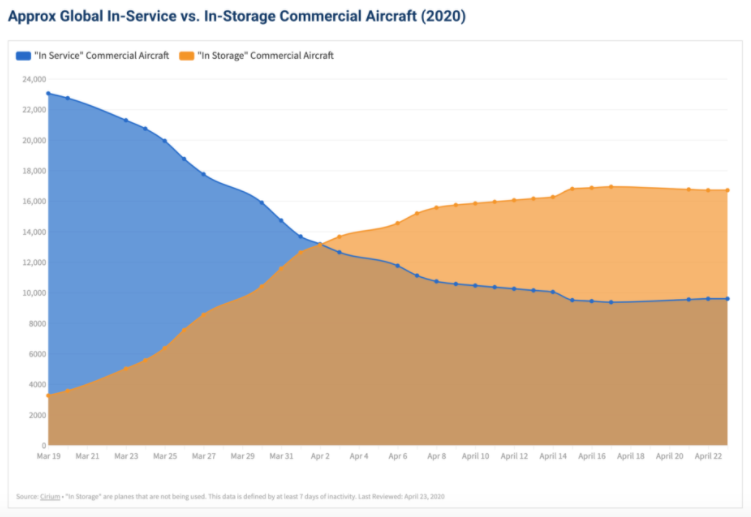

More aircraft are in storage as opposed to flying.

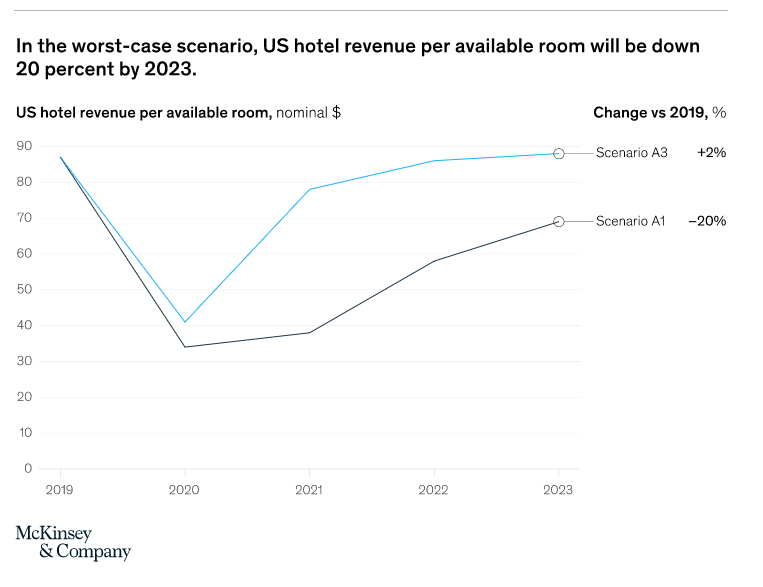

With no clear end in sight for the global pandemic, the hotel bookings are expected to recover very slowly.

Ideally, shifting to a long-term rental property can help you to avoid any major loss and be less susceptible to such variations.

More maintenance, less money

Short term rental properties receive all kinds of tenants who may not feel the need to take care of it as their own. They could keep your place great or damage it severely. There’s a constant upkeep required to maintain the place in top-notch condition. As a landlord, you need to ask yourself if you are ready to invest time in it or would like to hire a property manager. The seasonal demand and macro-economic conditions impact your income. Since the demand isn’t steady, you cannot always guarantee to channel the same amount on the maintenance of the property.

Oversupply of short-term rental properties in your area

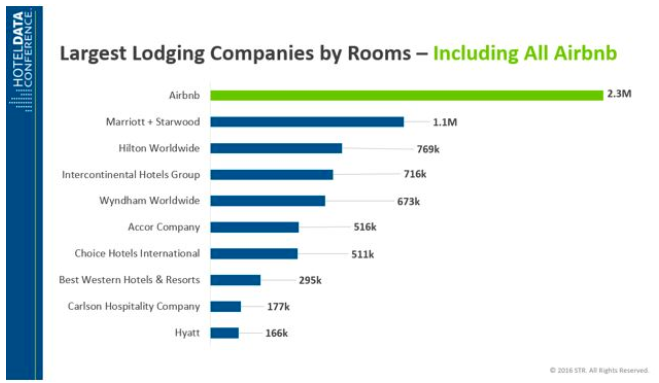

Destinations that expect lots of visitors usually witness an oversupply of options like Airbnb and VRBO. Greater the availability of alternate options, the lesser are your success of making much money out of your short term rental property. This chart shows how Airbnb has taken over hotels in the availability.

Converting short-term rental property to a long-term one

Short-term rentals give you more reward for the risk you take. In the current Covid-19 situation, the risk is beyond your control. Therefore, if you are considering changing to a long-term rental, here are some steps to take into consideration to bring about this change. We have a variety of resources at HomeKasa to help you get started.

Check demand for long-term rentals in your area

Carefully analyze the current and future market conditions in your location. The location plays a key role in determining the long term success of your rental property.

Choose the right price

Carefully study the rental rates in your location and then plan your offer. You need to set a rental price that not only attracts the ideal tenants but also benefits you long term and surpasses your expenditure on the property. If you live in an expensive area, it may be difficult to get immediate cash flow depending on your downpayment, expenses, expected rent, etc.

Know the applicable landlord-tenant laws

Access to property, the security of the house, property inspection, eviction notices – all these come in the category of landlord-tenant laws. The laws can vary by state and city, or the existing laws can be subject to change. Temporary moratoriums also impacts the landlords. As a landlord, you need to evaluate them before making the transition.

Plan your lease agreement before transition

Put in a bullet-proof lease agreement to protect your interests. HomeKasa offers a tenant onboarding package that includes an online lease agreement. You can store the agreement online as well. Decide if you want to allow pets in your property. There are many considerations that you should consider when you are converting your rental property to a long term one – things that did not bother you earlier may become a nuisance with long term tenants.

Screen the tenants

You wouldn’t bother about the short term tenants, but proper scrutiny of long term tenants is a must. With this transition, you would ideally want to choose the right kind of tenants so that they can rent for the long-term. It is best if you screen your tenants early on, check their prior landlord references, etc., to get a comfortable long-term landlord experience. Conduct background checks, credit score checks, and know about their prior eviction history.

The bottom line

Both short-term and long-term rental properties have their pros and cons. If you strategize smartly and follow the above-mentioned steps carefully, your long-term rental business can flourish and provide you with a stable profit. HomeKasa is here to help you make that breakthrough in the real estate business that you truly deserve.