8 Key skills to succeed in real estate investing

“To be successful in real estate, investors need to understand the macroeconomic and local market conditions, management skills, be good at communications, and more. We discuss how successful investors think and how you can benefit from their experience."

Real estate investing could sound like rocket science to those who are new to the topic. On the other hand, those who have invested a few of times learn some useful skills along the way that help them succeed. Won’t it be great if we can all take a few pages from the books of the successful investors and apply it for our benefit?

Being a landlord does not need any advanced degrees. Yet being successful in real estate requies both knowledge and skill. Instead of learning the keys to success in real estate investment through trial and error, it’s better to learn from others’ experience. That’s what this article intends to do. You can also explore more resources in HomeKasa to succeed in real estate investment.

While the top three things in real estate are location, location, location, there are also other key considerations. Here are 8 skills to be successful in the competitive real estate market:

1. Understanding the market conditions and risks

Understanding your target market conditions helps you with not only risk management but is also essential for real estate investing. As with the general economy, real estate has its ups and downs. Knowing how the market behaves and identifying patterns will help you to strategize your investments. Know your target location well and understand which neighborhood you are getting into. For instance, knowing the areas that are high in demand and the pockets that are expected to undergo significant developments will also come in handy. Keep in mind that speculation can be risky. Also, some neighborhoods bring better cash flow, while others appreciate better. Few offer both in the short run.

Cash flow or appreciation in real estate

When the economy does well, so does the real estate and vice versa. When the market is hot and expensive, the outskirts of a city tend to develop as people seek more affordable options. When the economy crashes, depending on the location, real estate prices tend to go closer to or below the prior peak price. How much below the peak? That depends on the underlying circumstances including what drove the price increase and whether the foundation is sound.

This chart shows how house prices fluctuated in the US at different economic cycles:

Now, let's take a look at a local market as an example. Here’s how the price fluctuations map with recession in the bay area:

Source: 30+ years of bay area real estate cycles – Compass

That said, it is hard to time the market accurately. Over the long run, things tend to even out. But in the short-term, prices could dip for a few years and then rebound. Understanding this pattern and using that to your advantage helps. Like Warren Buffett says, when everyone runs away, you go in.

Steps to buy a rental property

2. Management skills

As an investor, you have to simultaneously manage many things. The property has to be maintained regularly, and you have to check on tenants, conduct property inspections, collect rents, etc. HomeKasa automates property management through software so that you can be more productive. It’s to multiple screen applicants and select the right tenant, collect rent, conduct move-in and move-out checklist, and more. This frees up time for you to manage and grow your portfolio.

Move-in and move-out checklist

3. Effective communication skills

Working with the realtor, contractors, and tenants requires good communication skills. Negotiation and documentation skills are critical to the success of your business.

- Working with the realtor to explain your needs, and negotiate the right deal for you is important.

- Clear communications is important to avoid he-said she-said with contractors. Set clear expectations, write them down have signed agreements. Track miles stones as you go along. Communicate with and pay contractors through the HomeKasa software, simplifying the process.

- Tenants come in different flavors. While some are amicable, others are not. Document the condition of the house with our free online move-in and move-out checklist. Conduct property inspections and know what to look for. Share these with the tenants from the HomeKasa software directly. Also, communicate service requests, schedule repairs, etc., with the tenants through the property management software.

- As a landlord, you’ll also have to deal with court and lawyers from time to time. Effective communication skills come in handy here as well.

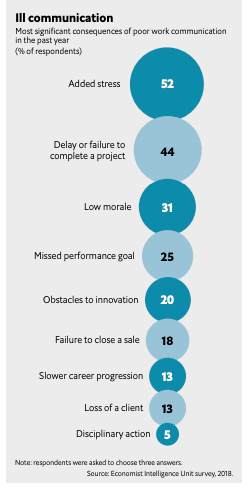

According to a study by The Economist Intelligenc Unit, poor communication causes both tangible and intangible impacts. It has caused a delay or failure to complete projects for 44% of the survey responders. Also, 52% of the survey responders were stressed and 31% had low morale. In real estate investing, this implies that your projects will be delayed, you may have to find new contractors or tenants, all of which cost you time, money and stress.

4. Understanding the demands of tenants

Renting, selling, and buying properties are not the only tasks of real estate investors; in addition, the role requires understanding the demands and concerns of tenants. You should have the skills to evaluate what requirements are justified, what is unnecessary, what requires timely action, and what can be delayed. Every property is unique in terms of location, structure, and financing – so learn to decipher and categorize the demands from tenants. Here are more tips on how to find and retain tenants:

Find ideal tenants https://www.homekasa.io/blog/find-ideal-tenant

All about tenant screening https://www.homekasa.io/blog/what-is-tenant-screening

What are next-generation of renters looking for https://www.homekasa.io/blog/prepare-rental-property-for-next-generation-technology

5. Patience

Real estate investment is not about instant gratification. Patience is a necessary skill in real estate investments. It takes time to understand the patterns and see a return on your investment. Identifying the right market and learning the market trends to find the best time to take action can only be done through patience. Many aspects of real estate investment demand patience – be it saving for a down payment, collecting funds, making deals, and waiting for improvement in the economy. However, the recompenses of patience are worth it in achieving optimal results.

When you are considering acting on an impulse, New York times recommends interrupting the cycle and examining the risks. Also, think about the bigger picture and how your actions lead to your long-term goals. This is why it is important to set goals and milestones to help you reach your long-term goals. While things seldom go according to plan, at least it helps you to move in the right direction.

Reach your long term goals with real estate

6. Persistence

Building your net worth is done over several properties over several years. Real estate is not a short term play. Very few people make it big in one real estate deal in residential real estate. Being focused and persistent is a crucial skill that you should have to succeed in investing. Follow up leads with persistence, stick with schedules, and manage resources well. Persistence can overcome great talent that’s lazy.

7. Financial management

Money goes hand in hand with real estate – you will deal with money to finance the purchase, and you will deal with income and expenses after the purchase. You have to carefully process the rent you are receiving, pay mortgage loans, cover repairs and pay contractors, and calculate the profits. You also have to consider taxes. Handling and managing money is critical and without proper financial management, you cannot succeed in real estate investment. That said, we are here to make your life easy. You can do all this from HomeKasa property management software. You can handle your investment property just as you would another investment – you can look at the income statements, profit and loss, all from one place.

How to set rent https://www.homekasa.io/blog/how-to-set-rental-rates

Key attributes of property management software

https://www.homekasa.io/blog/best-property-management-software

8. Planning and foresight

To be successful in real estate investing, you need to keep an eye on the bigger picture. If you plan your investments properly, within a matter of a few years, you should be able to invest in your next property. Planning should include not only how to save money for your next investment, but also how to maximize the value of your current investments.

https://www.homekasa.io/blog/16-steps-in-30s-for-financial-freedom-in-40s

https://www.homekasa.io/blog/buying-first-rental-property-steps

Undoubtedly, real estate investment comes with extraordinary opportunities if you keep adding value to your existing properties and invest in new ones. However, to handle all these, you need the right skills. HomeKasa has several resources that you can use to become successful in real estate investment. Our free online property management software makes it easy for you to manage your entire portfolio from one place. Get started now.