Should I refinance the mortgage? Think twice, we show you why!

When the mortgage interest rates drop, it's common to consider refinancing. We share some insights on things to look for before you refinance

If you can live in a beautiful house and pay for it later, won’t you? To add icing on the cake, what if you can pay for the house in manageable installments over the next few years? And better yet, unlike rent, the installments are fixed every month – they’ll never go up. Also, you don’t have to move unless you want to – no landlord is asking for their house back. But wait, there’s more! Unlike a lifetime of rent, you only have to pay these monthly installments for 30 years, or even 15! Does this sound like a late-night TV commercial? Well, this is what mortgage is today. Just like the TV commercials, there’s an equivalent of shipping and handling. They are called interest rates and closing costs in the mortgage world.

Wondering whether you should rent or buy? We’ve some thoughts here.

Let’s breakdown how the mortgage works for the borrower

Mortgage allows people to buy houses sooner than they can if they didn’t have a mortgage. Saving up to buy a million-dollar house in cash will take years. On the other hand, saving enough to put a down payment on a loan (say $150,000 or 15%) and paying off the rest of the loan (mortgage) in monthly installments (mortgage payment) is a lot more manageable for some people. This helps people to achieve their American dream sooner and enjoy a better quality of life sooner.

Cash or mortgage? Which one is the right option to buy a house?

How does mortgage work?

Many people look at the mortgage payment as a fixed monthly amount and intuitively understand that a lower interest rate implies either a lower monthly payment or a bigger house. However, very few homeowners fully grasp the concept of amortization and the schedule.

The mortgage payment every month is usually made of two components – one is the principal and the other is the interest. The principal goes towards paying off the purchase price of the house and the interest goes to the bank for loaning the amount. Because money today is worth more than the same number 10 years from now, banks focus on getting their share of the money sooner. To put it simply, while $100 bought food for you and your family of 4 for a month a few decades ago, it can barely get you food for a few days today – the cost of living has gone up. A bank knows this well, and they want to get their money now instead of later in the 30-year mortgage. During the early years of the mortgage loan, most of the monthly payment goes to the bank as interest.

As an example, let’s say you borrow $1,000,000 at 5% interest from the bank to buy a house and pay installments on the 1st of every month. Let’s look at the breakdown for this scenario.

Loan term = 30 years Monthly payment = $5,368.21 Total principal = $1,000,000 Total Interest = $932,557.84 Total payment = $1,932,557.84

When you breakdown the mortgage payments this way, you can quickly see that your $1,000,000 loan is not just $1M anymore. In fact, you’ll be paying back almost $2M. That’s the cost of not buying the house with cash. The question is, does the location you purchased the house in keep up with both inflation and appreciate enough to be worth at least $2M in 30 years? When you add remodeling expenses, repairs, and ongoing maintenance, this number quickly looks daunting.

To add to the above, you should also consider the amount of money you put down to get the loan. This is usually anywhere from 0% to 25% minimum, and you always have the option to put more. There are also closing costs including the lender costs for the bank and the title fees, etc. Some communities also have homeowners association fees. And don’t forget the property taxes and insurance. Buying a house is a major life-event, and for many, it is the biggest asset in their portfolio. This is why real estate is a long-term investment.

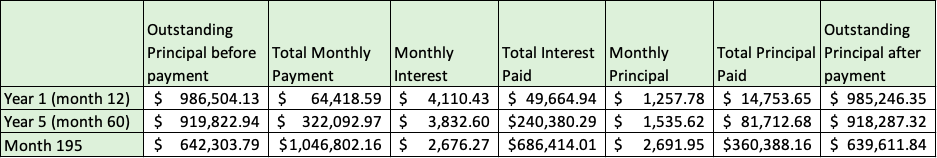

Now let’s just look at how much you are paying in year 1 and years 5. Also, just to put the percent of interest paid in the beginning, we show you month 195 in the table below.

In year 1, as the table above shows, your interest portion of the monthly payment is $4,110.43 and the principal portion of the monthly payment is $1,257.78. Even though you have paid the bank $64,418.59, only $14,753.65 went towards your principal. The rest of your payment for the year, $49,664.94 went towards the interest for the loan. It’s depressing to look at, we know! Does it get better in a few years?

Well, at 5 years, your outstanding principal is $918,287.32 even though you have paid $322,092.97 in total. Even as of now, you pay more in interest every month instead of the principal. In fact, you have paid $240,380.29 to the bank as the interest for the money you borrowed. The bank knows that the present value of the money is more than the future value of the money. So, they take more money upfront from your monthly payments. This implies that when you decide to sell or refinance your house, your mortgage loan amount is still $918,287.32. You may not have much equity in the house unless your property prices appreciated decently.

At about year 16, month 195, is when the monthly payment equally covers the loan and the principal. Interest portion of our monthly payment is $2,676.27 Principal portion of our monthly payment is $2,691.95

After this, the principal takes over, where more of your monthly payment goes towards principal than interest. But by then, your monthly payment to the bank for the last 16 years has now amounted to $1,046,802.16. But your outstanding principal is 642,303.79.

We hope this sheds some light on how you get to enjoy the house while the bank gets their interest. For real estate investors, the expectation is that once they put the down payment and get the loan, they can rent the property to someone else. The rental income should cover all the expenses and leave some positive cash flow. This may or may not be possible depending on the location and the amount of down payment. This is why many real estate investors emphasize on cash flow.

Read our articles on cash flow vs appreciation, investing in expensive markets, and investing in college towns. This is also why some people like to rent their entire house for the short-term like Airbnb, VRBO, HomeAway. The income from these properties can be higher than renting a place for the long-term, as the homeowners are taking a higher risk.

Consider this before you refinance your property

When the interest rates drop, it is natural to be inclined to refinance the property as this reduces your monthly payments. The reduction in the monthly payment is due to the lower rates and the lower principal amount. Depending on when you refinance, the outstanding principal on your mortgage will be lesser than your purchase price. Lower balance and a lower interest rate equals lower monthly payment. But before you dive deep into refinancing and pay loan fees, let’s look at how this plays out, and whether refinancing is the right option for you.

Let’s say that the new interest rate is 4.75% on a 30-year mortgage, instead of your current rate at 5%. Also, let’s say that you are refinancing at 5 years into your mortgage. Now, the entire mortgage duration from the time you purchased the house is 35 years. Keeping that aside, let’s look at the math.

Your monthly payment goes down to $4,790.22, that’s a savings of $580 per month! Therefore, it looks attractive and people often use this plain math on monthly payments and decide to refinance.

But, let’s take this a step further, and breakdown this scenario. Since you are refinancing at the end of year 5, you have already paid interest for 5 years in your original 5% loan. This amount is $240,380.29. However, most people would say that this is a sunk cost. It’s water under the bridge and you can’t recover it. What you need to focus on is what’s forward. So, let’s look at what’s forward.

Loan term = 30 years Monthly payment = $4,790.22 Total principal = $918,287.32 Total Interest = $806,192.37 Total payment = $1,725,479.69

Now, let’s look at how this plays out. In your original loan, your outstanding balances at 5 years were: $773,965.53 in interest, summing up to total payments of $1,723,197.41 for 25 more years. These numbers go up when you refinance to a lower interest rate. This is counter-intuitive – you try to save money, but it is a short-term saving and it costs you more in the long-term. For some people this makes sense – freeing up cash every month, means they can buy another house or invest in other instruments with different returns, diversifying their portfolio. Our recommendation is that you make this a conscious effort. Otherwise, you’ll end up paying more than what your original loan required you to.

Please note that the numbers given here are examples. You change one thing and the math changes completely. For example, if the new interest rate were 4.5% instead of 4.75%, you’d barely come out ahead after considering the closing costs. Likewise, your loan amount changes the math as well. Also, when you refinance determines your outstanding principal on the old loan and it is the amount for the new loan.

Some banks try to sweeten the deal by allowing you to add the cost of refinancing to the loan amount. This no-cost refinancing looks like an impeccable deal to pass. But keep in mind that you are paying interest on that closing costs for the next 30 years.

Making extra payments in your mortgage help to reduce the loan period and the interest rates. Even if you pay an extra $100 per month, that amount goes directly towards your outstanding principal balance. Therefore, the interest owed to the bank goes down and more of your monthly payment will be allocated towards the principal. This is the idea behind paying twice a month and making extra payments to reduce your mortgage term. How much do these extra payments save you? Most online calculators can tell you this. But, what happens if you make extra payments for some months and just make regular payments during the other months? What if you want to pay even more on some months?

Well, HomeKasa has got you covered. You can use our calculator to find out how extra payments impact your loan. If this is not enough, we even take it one step further and tell you if you should refinance your mortgage. We will automatically calculate and determine whether refinancing makes sense in your situation, based on the current interest rates, and your outstanding mortgage. We have lived through this and know the challenges of homeownership. Our goal is to make it easy to help you build your wealth through real estate.

HomeKasa offers the best property management software. It’s easy to track your expenses, see profit and loss, schedule repairs, collect rent, communicate with tenants and repair service providers, and more – all from one platform. It’s free, get started now.