Why should you track repair and update expenses for the house?

Tracking your expenses helps with budgeting, saving for the future, and to deduct expenses for IRS. Read our tips on how to do this easily

If you own a house, or even better, have a real estate portfolio, you know that owning a property is not a one-time expense. In addition to the mortgage, taxes, insurance, you need to keep investing in your property to keep it presentable.

In between the major updates, there are likely to be many regular maintenance and repair needs. Maintaining your house becomes all the more important, as well as difficult when you rent it out. Repairs are inevitable to keep any rental house in the best of its form, be it a residential house or a commercial property. Different renters using your property in their own ways sometimes makes maintenance a hassle.

Why tracking your expenses is critical?

About 75 percent of adults, when inquired about how they are doing financially, say that they are just fine, but not too well. This is because around 60 percent of adults in the US accept that they do not have the habit of tracking their expenses.

Why keep track of expenses on a rental property?

There are several reasons to track your expenses, including:

Managing your finances

Tracking your expenses on the house helps to manage your overall finances. You will know how much you have already spent, how much of the running finances are available to you, and how you can manage your remaining expenses from those available finances. According to the U.S. federal reserve study in 2019, three in 10 adults experience changes in finances from month to month. By tracking your expenses, you can manage your finances better.

Keeping expenses in control and encourages saving

Once you have a track record of the expenses incurred, you will be able to identify how many of these expenses were unjustified. This will help in controlling impulsive expenses in the future. 17% of adults could not pay their bills in full in 2019. Also, you ultimately start being more cautious in your spending behavior, and this leads to a habit of saving.

Keeping track of progress

When you track your expenses made on the house, you should also record all the expenses on repairs and maintenance. This allows you to check the progress on maintenance and renovations.

Help being organized

Tracking expenses and activities also help you in being more organized. Things that are penned down give better insights and make decision making easier in the future.

Gives a sense of security

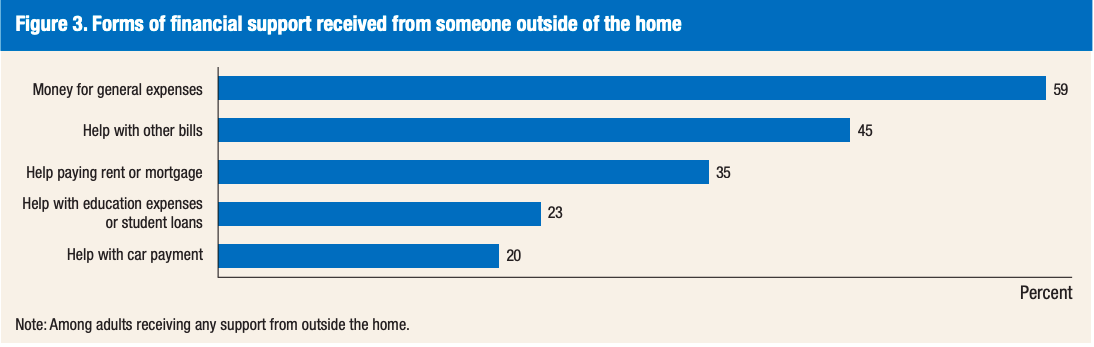

Saving gives you a sense of security for the future as well, as you will know what you have in store for the future needs in terms of repairs and maintenance. The image below shows the breakdown of how Americans use the support money received from others, according to the U.S. Treasury’s study.

Reduces stress

Being more organized, being able to track the progress of your set targets, and developing a habit of saving reduces overall stress, particularly the stress related to property management. Studies show that over half the renters needed repairs for their homes. Planning helps landlords to budget for these expenses.

Helps maintain evidences

While recording and tracking your expenses, keep evidence of those expenses as well, like invoices, warranty cards, etc. This helps in case of any problems with the new parts or equipment purchased, and the services availed.

In all the frenzy of property maintenance, the expenses that are incurred sometimes go out of budget. It is, therefore, of utmost importance to create a planned budget for house maintenance and to track all your expenses to keep them under control.

Tax deductions

While a primary home benefits from expense tracking by allowing you to stick to your budget, an investment property brings the added advantage of tax deductions. Many expenses incurred on rental properties are tax-deductible – they are considered a business expense.

HomeKasa allows you to track expenses easily. You can look at different categories and understand where you spend the most, whether you have one or more properties.

Tips to track expenses on rental property

The following are a few tips that can help you track, as well as control, your expenses on the house.

1. Categorize your expenses

The expenses made for various purposes and in different areas of your house must be categorized to be sure you are not addressing one area and ignoring others. For example, while decorating is fun, replacing a leaky faucet is more urgent.

We have a series of blogs to guide you on updating and maintaining your kitchen, bathrooms, and other areas of your house, particularly if you are planning to rent it out. [Read How to Update Bathroom in a Rental Unit and How to Update Kitchen in a Rental Unit]

2. Utilize technology

Technology is now changing the face of property management; so, you should start utilizing it too for tracking your expenses. At the end of the year, you can simply roll up these expenses and submit them for accounting and taxes. At any time of the month or day, you can evaluate the profit and loss of your properties. HomeKasa makes this a breeze. It’s your wealth – stay on top of it.

3. Manage the frequency of update related expenses

Landlords often make the mistake of overdoing or not spending enough on maintenance. Some of them get obsessed with updates and keep spending on it unnecessarily. The best you can do for your wallet is to identify when to inspect your property and wisely assess where an expense is justified.

4. Types of expenses to keep track of

A lot of homeowners think that smaller expenses are not important enough to keep a record of. If you want to make the maintenance and renovations budget-friendly, make sure you track even the smallest of the expenditures. This will also help in identifying the expenses that can be controlled, minimized, or even avoided.

Owning one or more homes is a significant part of your portfolio. Houses are expensive purchases. By tracking these expenses, you can stay on top of where and how your money is being spent. The best part is that these are tax-deductible for investment properties. HomeKasa makes it easy to track them and to monitor your profit and loss.